The audit of going concern is often a challenge. Here we look at what a good audit file looks like in the context of going concern.

Related content

This case study is one of a series of three. It can be used independently or in conjunction with the full guidance and / or the full training materials.

2.1 Introduction to the case study

This case study has been prepared based upon a realistic scenario that is intended to demonstrate ‘what good looks like’ in these particular circumstances.

The case study is intended to be an illustrative example of how good auditors might respond to a particular set of circumstances. It is not a model or template that can be followed regardless of the specifics of the audit. This case study does not consider every action that needs to be taken by the auditor in relation to going concern. Instead, it focuses on specific aspects of the work in order to illustrate what good looks like in that respect.

This case study is particularly focused on:

- the iterative nature of risk assessment

- management bias

- challenge and scepticism

- the impact of contradictory audit evidence

- narrative reporting

- audit documentation

- engagement partner and second partner review

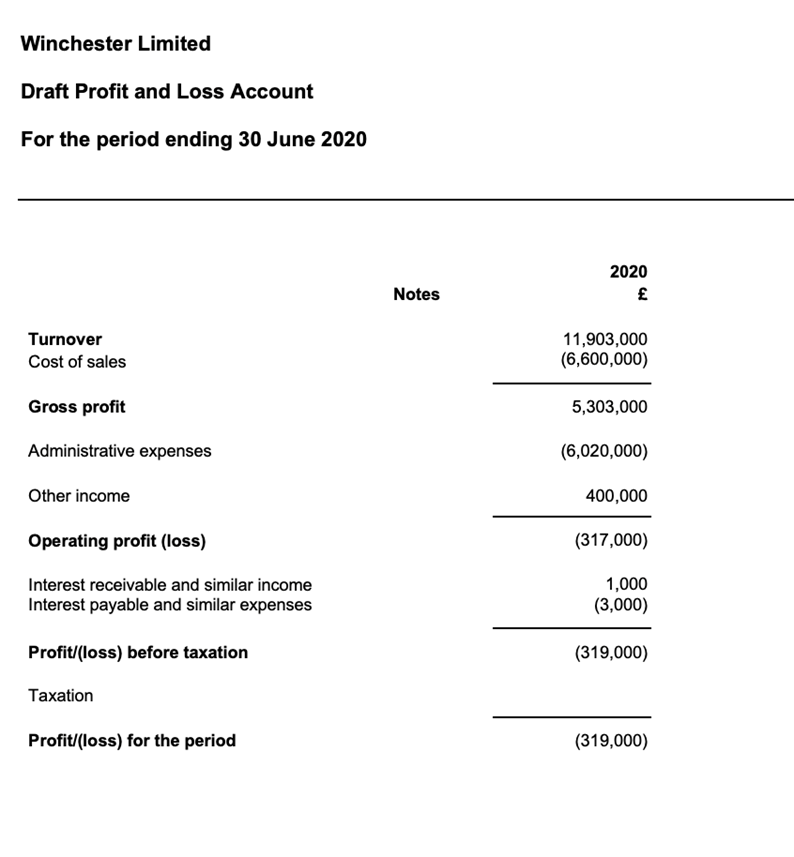

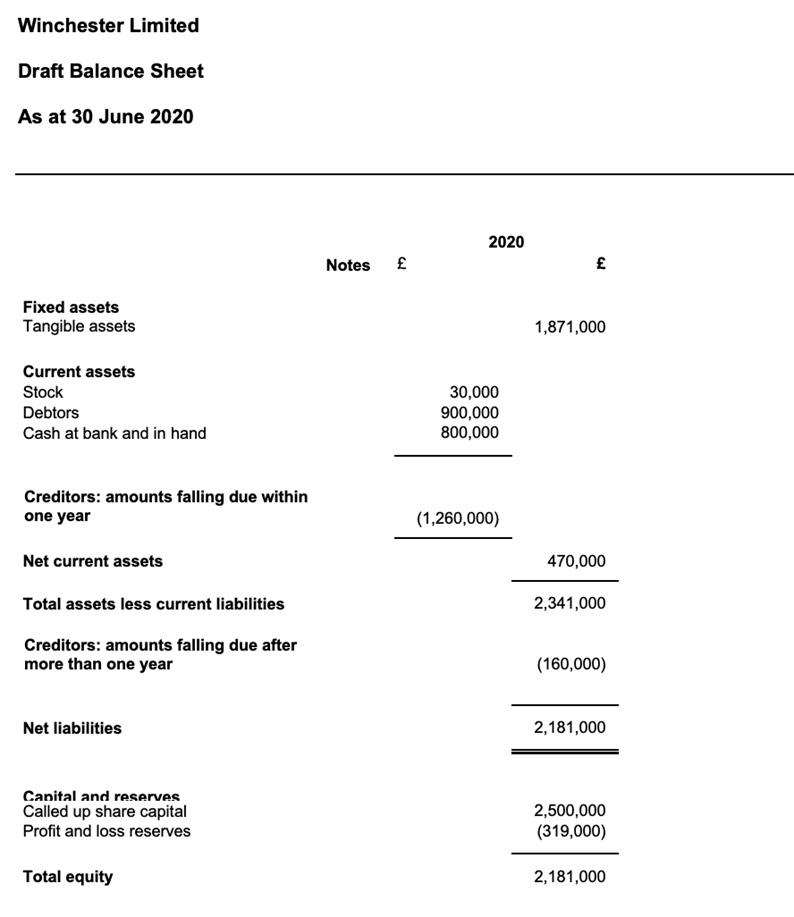

2.2 Relevant extracts from draft financial statements

2.3 Winchester Ltd - period ending 30 June 2020

| Illustration – Extract from the planning memo |

|---|

This is a first-year audit. There have been extensive planning discussions with management that have confirmed the following, to establish our knowledge of the company: Background about the company Winchester Ltd was a new start up when it opened four restaurants in the Autumn of 2019. The company is owned by the friends and family of a famous celebrity chef (John Bernie). Mr Bernie controls the company. There was a significant share issue of £2.5M to fund the business’ start up and there are no shareholder/director loans. Impact of COVID19 Before the first COVID19 lock down in March 2020, all of the restaurants were proving very popular and had good reviews together with months of forward bookings (the booking system was reviewed as part of the walkthroughs). Trading in the summer of 2020 was similarly encouraging, as shown by the management accounts. During the COVID19 pandemic, Winchester Ltd has taken advantage of all available government assistance including a Coronavirus Business Interruption Loan (CBILs). |

2.4 The risk assessment was iterative

When the audit was planned in the summer of 2020, there was a great deal of optimism about the future, and the auditors’ risk assessment reflected that. However, as the second and third lockdown in England came and went, the circumstances surrounding the going concern review were constantly changing, with new uncertainties arising and previously identified uncertainties resolving themselves.

The directors chose to significantly delay the completion of the financial statements in the hope that the future would become more predictable, in order to avoid having to make material uncertainty disclosures related to going concern, that they believed might affect the confidence of the investors in the business and affect the reputation of Mr Bernie and consequently impact on his TV work.

The auditor’s risk assessment and the planned response is necessarily iterative. Audit risks and appropriate responses are reassessed whenever the circumstances changed. Also, the delay in finalising the financial statements triggers the requirement for the auditor to undertake further audit procedures (ISA 570 para 26).

The auditor also took into account management’s bias towards not having to disclose material uncertainties.

Risk documentation

Before signing off, the auditor ensured that the risk assessment was updated and reflected the going concern risks present at the time the audit was completed.

| Illustration – Extract from going concern audit documentation |

|---|

Risk factors and inherent risk assessment A summary of the key indicators and events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern. Updated risk assessment at xx/yy/2021 Current and future trading: At the point that the financial statements are being finalised all four restaurants are open and trading well as seen through daily takings reports. In England the government’s strategy remains to lift restrictions in June 2021. Whilst no further lockdowns are planned, uncertainties remain around future trading conditions. There remain significant audit risks related to going concern. Because of strong trading figures, the risks around the use of the going concern basis are reducing but the risks relating to material uncertainties existing and needing to be disclosed remain very high. Management’s delay in finalising the financial statements and management’s motivation to avoid what they see as damaging going concern disclosures, both support this risk assessment. Audit work is highly focused on this. Appropriate responses to these risks are recorded on Sch T1. Post Brexit staff recruitment – new risk identified: It was identified, close to sign off, that a number of news stories were running that as a result of Brexit, foreign nationals working in hospitality had returned home and that there was a shortage of trained staff. see schedule T8 for discussions with John Bernie and T9 for revised cash flow forecasts taking into account the possibility of increased staff costs. |

2.5 Management bias

The auditors identified that there was management bias in relation to going concern and documented their evaluation of its impact on the audit.

| Illustration – Extract from planning memo relating to going concern |

|---|

Management bias John Bernie is very proprietorial about the restaurants. He considers them to be part of his brand as a TV personality and is very sensitive to anything that the public might view negatively. Because the governance structure is highly informal and John Bernie controls everything it is likely that his attitudes to the restaurants will give rise to strong management bias. It is possible that this could lead to forecasts being optimistic and any necessary disclosures being overly positive. Also, management might be motivated to conceal evidence of current financial difficulties or future problems, creating a fraud risk. Fraud risks (including management override) are addressed in the risk assessment documentation. This will have a significant impact on the audit approach and audit evidence, related to going concern, provided by management will have to be addressed with the appropriate level of scepticism. |

2.6 Auditor independence

This is a first-year audit and the auditors have not previously had any dealings with John Bernie.

The auditors’ initial assessment of independence focused on their provision of non-audit services, namely assistance with the preparation of the financial statements and corporation tax work. However, during the audit, the company appeared to need some help with the going concern assessment and it became clear that John Bernie was applying pressure on the audit team to avoid the need for disclosure of a material uncertainty related to going concern and a material uncertainty paragraph in the audit report.

The assessment of auditor independence was appropriately amended.

| Illustration – Consideration of auditor independence |

|---|

Threats to independence Self-interest threat No – fees are low and in particular the fees from non-audit services are low. No business, employment or personal relationships. Self-review threat Yes – we compile the financial statements into Companies Act formats from the management accounts and prepare Corporation Tax computations and the CT600. During the audit, management also asked for assistance with the going concern assessment. We provided our Excel template, but didn’t assist in any other way. For the purposes of these non-audit services, the company’s finance director is informed management. Management threat Yes – see self-review threat for provision of non-audit services. Addressed with use of informed management to make management decisions. Management also asked for assistance drafting the going concern disclosures, but we declined because of the nature of the self-review and management threats. We provided some examples of the disclosure instead. Advocacy threat None Familiarity threat None - no long association or close relationships Intimidation threat Yes – during the audit it became clear that John Bernie is very protective of his reputation and reacted very strongly when it was suggested that there is a material uncertainty related to going concern, pushing back against the audit manager and partner. Safeguards All non-audit services are provided by separate teams, from the professional services and tax departments. The professional services team have been briefed not to prepare the going concern disclosure or assist with the going concern assessment. The intimidation threat is of a nature that it needs to be addressed with a safeguard and this will be dealt with as part of the second partner review. |

2.7 Material uncertainties

Based on management’s final going concern assessment, the auditor carefully considered whether material uncertainties related to going concern existed and they concluded that they did. Management’s cash flow forecasts showed positive cashflow for the next 12 months and the latest monthly management accounts were encouraging. This forecast assumed a very strong recovery for the economy in 2021 and a good performance for what still is a new restaurant group with a very limited track record. However, headroom in terms of cash remained tight. The funds raised through CBILs borrowing have already been used to fund losses during 2020 and management have indicated that no other sources of further funding are available.

The auditor challenged management’s going concern assessment when considering the methods, assumptions and data used in the cash flow forecast. Also, corroborating evidence was obtained to support the cash flow forecasts and management accounts, such as inspecting future bookings for the restaurants and reviewing the underlying accounting records from which the management accounts were prepared, particularly the income from outdoor dining in April.

The auditor also flexed management’s cash flow forecasts and considered that there could be possible downside scenarios where Winchester Ltd would not be able to meets its obligations as they became due.

The directors of Winchester Ltd were very reluctant to accept the auditor’s assertions that the restaurants’ income could be subject to significant uncertainty over the next 12 months and that the directors were possibly presenting an optimistic scenario in their forecasts. The auditor was also conscious of the possibility of management bias in the forecasts and was forced to challenge management very strongly. This included the auditor asking management to support the fact that their forecast income was assuming a rate of recovery significantly ahead of expectations in the hospitality industry in general. The directors’ response was not sufficient to persuade the auditor that there were no material uncertainties.

| Illustration – Extract from going concern audit documentation |

|---|

Evaluation of management’s going concern assessment Management have prepared a cash flow forecast for the next 12 months, using an extrapolation of the covers served from November 2019 to mid March 2020. This is not an unreasonable method to use but management were asked, by the auditor, to use scenario planning and to consider stress testing. They do not consider this necessary or useful and are confident that their targets are achievable. Given the assessed inherent audit risks it is possible that management could be overly optimistic in their forecasts and they appear to be ignoring the inherent uncertainties in respect of the possibility of future lockdowns, the possibility of operating at under-capacity due to social distancing requirements, the health of the economy in general and the prospects for their restaurants in particular. Management have been challenged over this approach but are very confident in their assessment. The assumptions used by management in their cash flow forecasts have been consistently and properly applied in the cash flows, the cash flows cast, the base data used by management has been reconciled back to bookings when the restaurants first opened in 2019 and the starting point of the forecasts have been agreed back to the latest management accounts (Sch T3.3) The opening bank balance has been checked to the online banking (copied on Sch T4.1) and other working capital balances have been checked to underlying records. All key assumptions have been reviewed for reasonableness (Sch T3.4). The most critical assumptions made by management are:

Management were asked to support these assumptions and provided the following:

This supports management’s assumptions but remains well ahead of expectations in hospitality (see T6 for article in The Restauranteur). Mr Bernie was challenged as to why Winchester Ltd will perform better than other restaurants. He explained that his lockdown cookery TV show was very popular, as was his lockdown cookbook, which have raised his profile. The assumption that the restaurants would not have to close in the foreseeable future or be forced to restrict the number of covers served due to social distancing protocols (assumption 3 above) was also challenged. Management were unwilling to accept that there was a possibility of further restrictions – see conclusions below. We have flexed management’s forecasts for severe downside scenarios (Sch T7), which demonstrate inadequate headroom to meet obligations as they fall due. We have also considered the impact of the 5% VAT rate that applied from July 2020. The restaurants did not pass on the VAT saving to their customers when the VAT was lower, so there is no expectation that this might have impacted on bookings or gross revenue, although it did improve the company’s profitability. Also, the basis period for the forecasts is 11/2019 to 3/2020, where the 20% rate applied which is consistent with the rate that management have assumed in all their forecasts. Therefore, the change in VAT does not have an impact on the going concern assessment. Conclusion Whilst management have some good evidence to support their forecasts, there is limited consideration of downside scenarios that might be severe but plausible, particularly in relation to the possibility of further forced closures or limitations to operating through social distancing protocols because of COVID 19. There is contradictory evidence that suggests management’s forecasts could be optimistic. Namely, the possibility of future COVID19 restrictions and the possibility that trading might not be as strong as is hoped. These issues are addressed in our flexed cashflows on T7. This audit work clearly supports the use of the going concern basis. However, despite there being sufficient audit evidence to support the use of the going concern basis, there is clear evidence of material uncertainties related to going concern because of the possibility of future COVID19 restrictions and uncertainty about future trading conditions. This point has been taken forward to points for the partner to discuss with management.

|

2.8 Enough but not too much audit documentation

The auditor effectively completed the audit work on going concern on four separate occasions, as the finalisation of the audit was repeatedly delayed because management were seeking to avoid a material uncertainty related to the going concern paragraph in the audit report. The risks were different each time, management presented a different assessment of their going concern position and different elements were challenged and corroborated by the auditor.

The final going concern assessment was done when the restaurants had successfully opened for outside dinning and it was clear that it was likely that they would, very soon, be fully open again.

Management’s latest cash flow forecasts were kept on file together with the last monthly management accounts, as these were thought to be important documents for any file reviewer to have access to, in order to appraise the decisions reached by the auditor. Important emails from management and the accounts team were filed, for the same reason. These documents demonstrated how the auditor had to very strongly challenge management over the basis of preparation of the cash flow forecasts.

The auditor used the firm’s standard template to summarise their evaluation of going concern, in order to collate the work that was done to clearly support the final conclusions on going concern.

The auditor removed irrelevant refences to audit work done previously from the current audit file in order to ensure that it was clear that they were only taking into account the new information in forming their conclusions on going concern.

The illustration below shows what the auditor of Winchester Ltd has on file.

| Illustration – Extract from going concern audit documentation |

|---|

Section T Going concern – Contents list T1 Going concern summary memo |

2.9 Disclosure in the financial statements

The auditor reviewed the disclosure in the financial statements, conscious of the risk of management bias and the directors’ concerns over the public image of the company and Mr Bernie himself. Management have included some going concern disclosures about the more positive position that Winchester Ltd finds itself in at the date the financial statements are signed off, without making it clear that there are material uncertainties about future income flows that could leave the company in a position where it cannot meet its obligations as they fall due.

The auditor challenged the directors, stating that it was their view that there were material uncertainties about future cash flows which created significant doubt about the use of the going concern basis.

Very reluctantly, management included disclosures of these material uncertainties and after several drafts and meetings with the auditor, they were agreed, by the auditor, as appropriate.

Documentation

The auditor documents the audit evidence obtained, and all necessary corroborating evidence, to support the disclosure drafted by management. The documentation clearly sets out how the above audit conclusion was reached and how management were appropriately challenged.

| Illustration – Extract from going concern audit documentation |

|---|

Disclosure of material uncertainty in the financial statements Management have accepted that there are material uncertainties that need to be disclosed in relation to future trading conditions and the possible impact of COVID19 in the future. The first draft of the disclosures (Sch T5.1) were produced by John Bernie. Our proposed amendments were accepted (email chain Sch T5.2) and the final version was agreed as appropriate (Sch T5.3). It is clear that the uncertainties in relation to future trading performance and the possibility of further COVID19 restrictions are material uncertainties casting significant doubt on going concern. |

2.10 Strategic report

The auditor reviewed the strategic report for compliance with applicable legislation, material misstatements and consistency with the financial statements.

Management’s first draft of the business review recognised that it had been a difficult year but was very positive about how well the restaurants had performed and about the future of the business. The auditor identified that the comments about the future prospects of the business were not consistent with the material uncertainty in relation to future trading.

The auditor challenges this and asks management to include a specific reference to the going concern position. The following is included in the strategic report:

| Illustration – Extract from Strategic Report |

|---|

Going concern The business is facing a challenging time as it opens up after what is hoped to be the last COVID19 lockdown. Restaurants might have to operate at lower capacity due to social distancing requirements, there might be difficulties tempting customers back into our restaurants and there could be the possibility of further lockdowns or restrictions. These material uncertainties related to going concern are set out in note 2a to the financial statements. |

2.11 Engagement partner review

Most of the latter audit work related to going concern is done by the audit manager. This includes the work done on management’s cash flows, challenging management’s assertions, the review of disclosures and the strategic report, the revision of the risk assessment and documenting the audit conclusions.

As this audit work needs to be reviewed, it falls to the audit partner to do this and ensure that their review is adequately documented. This also involved discussions with the audit manager about their work.

Obviously, the audit engagement partner is involved with discussions with management. Also, the audit engagement partner and the audit manager regularly discussed going concern issues as they arose, whilst the audit was ongoing. This means that the audit engagement partner’s time commitment in this audit is very significant. Much more than would have been if the going concern issues had not arose.

2.12 The audit report

A material uncertainty paragraph was included in the audit report.

| Illustration - Winchester Ltd – extract from audit report |

|---|

Material Uncertainty Related to Going Concern We draw your attention to Note 2 which indicates that there is uncertainty about future trading conditions because of the COVID19 pandemic. It is not certain when restaurants in England will no longer be required to restrict their activities, what social distancing measures might then be required, how far the capacity of the restaurant could be restricted or whether the business will be effected by future lockdowns. As stated in note 2, these events or conditions, along with other matters as set forth in note 2 indicate that a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern. Our opinion is not modified in respect of this matter. In auditing the financial statements, we have concluded that the directors’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate. Our responsibilities and the responsibilities of the directors with respect to going concern are described in the relevant sections of this report. |

2.13 Second partner review

The audit firm has a policy that such audit reports trigger a requirement for a second partner review and/or a technical review by the central technical team.

The audit partner for Winchester Ltd chose to have a second partner review, rather than a technical team review, because of the pressure applied on the audit team, by management, over the material uncertainty disclosure, to act as a safeguard against possible threats to independence and to review what was thought to be a difficult judgement call.

The second partner review took place after the disclosures had been finalised and the audit report had been drafted, but not signed. The reviewer focused on the financial statements, the wording of the audit report, the going concern audit documentation and had discussions with the audit partner and manager about the conclusions that they reached and why.

The extent of the review was documented together with the reviewer’s conclusions.

| Illustration – Extract from going concern audit documentation |

|---|

Second partner review Reason for review Material uncertainty paragraph related to going concern in audit report and possible identified intimidation threat because management are applying pressure to avoid the material uncertainty para. Work done

Conclusion I agree with the conclusion reached by the audit team. There is sufficient appropriate audit evidence to support that Winchester Ltd is a going concern and there was sufficient work done and challenge of management to identify any material uncertainties related to going concern. The going concern disclosures are appropriate, as is the wording of the audit report. |

Download case study 2

PDF (495kb)

Download a copy of the case study Winchester Ltd, to print or save.

Download